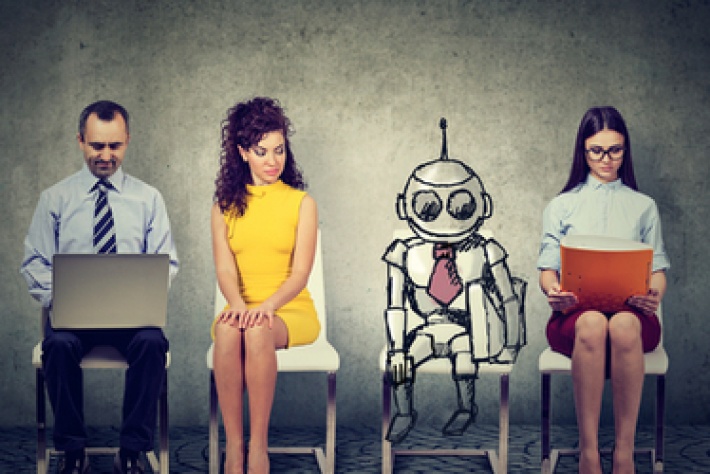

9 in 10 Accountants Expecting Tech to Change Their Jobs by 2028

More than 90 per cent of accountants expect to see developments in technology change their jobs substantively over the course of the next decade.

That’s according to research carried out by Thomson Reuters, which has been canvassing opinions on expectations for the future among accountancy professionals across the UK.

A majority of those asked said they expect cloud computing and the availability of real-time data to have a significant impact on their roles as accountants by 2028.

Almost two-thirds (59 per cent) of the people polled said they view real-time data as a positive tech-driven development for accountancy professionals.

No fewer than 96 per cent of the accountants asked said that they consider diversification of services to be an important operational issue as new technologies emerge and have an impact.

There was a widespread appreciation among accountants that they might need to add new skills and capabilities to their service offerings as automation technologies come to be increasingly in use.

Thomson Reuters’ researchers have said that by 2028 accountants expect to be spending considerably more of their time focussed on advisory services and providing guidance in areas such as IT, business planning and tax consultancy.

“The tax and accounting profession is facing multiple sources of meaningful change, including new legislation and a wave of new technology that will impact both their own and their clients’ businesses,” said Charlotte Rushton, president of Thomson Reuters’ tax professionals business.

“Accounting and tax professionals who increase their focus on adopting and becoming proficient with next-generation technologies, while incorporating higher-value advisory services into their mix, will position themselves for a stronger future.”

Stephen Pell, founder of music accountancy firm Pell Artist, said: “Technology is going to make life much more enjoyable and rewarding for an accountant, and it will only bring benefits to the adviser, and to the client.”

“In 10 years’ time there will still be a need for my role as an accountant, as long as I progress with change and rebalance the core of bookkeeping services versus advisory services from a 50-50 split currently, to 25-75,” added Freddie Faure, from CooperFaure Accountants.