Tax Return Services

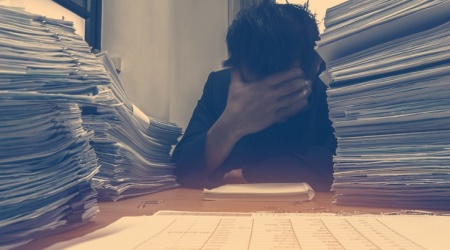

Ensuring compliance with tax reporting requirements on both a personal and corporate level has become increasingly challenging in recent years. It is easy for the expectations and demands of HMRC to take away your focus from running the company, often resulting in reduced overall performance at the end of the year.

That is why engaging the help of a professional can make a difference to many areas of your business. Not only do you gain peace of mind as a director that your company is fulfilling all its obligations, but you also remove the distracting backdrop of dealing with complex tax affairs.

In this respect, we can offer you a reliable recommendation of an expert who can help. We have developed trusted working relationships with accountants in your locality, and it is this long-standing awareness of their professionalism and technical expertise that allows us to confidently introduce you.

Meet all statutory deadlines and requirements

Handpicked Accountants takes away the uncertainty of finding a reputable advisor. Our professional connection with the leading accountancy practices in the UK means that every referral can be trusted, and has the potential to make a huge difference to your business.

- Refocus on building sales and driving the business forward, rather than dealing with administrative issues

- Ensure personal and corporate tax compliance

- Reduce the stress of running your company