How to keep good financial records for your business

Regardless of if you are just starting out as a sole trader or you are already the director of a successful limited company, keeping good financial records for your business is vital. However for many people knowing where to start with accurately yet easily recording their finances can feel like a minefield.

Why keeping good financial records is important

There are a number of reasons why it is important to make sure that you are on top of your business’ finances and that all of your records are being kept in good order.

- Easier to file your tax return or annual accounts – when it comes to submitting your annual reports then having all of your financial records neatly in order will make this job much quicker and easier.

- Save money on accountancy fees – if you choose to employ an accountant or bookkeeper to help you with your finances their job will be much easier and therefore quicker and cheaper if they do not have to wade through mountains of disorganised records first.

- Avoid HMRC fines – not only is it a good idea to keep good financial records but it is also a legal requirement. HMRC can impose fines of up to £3,000 for bad record keeping.

- Understand where your business is booming or failing – keeping accurate financial records will allow you to see where your business is doing well and also any areas where it is doing badly. This will help you to streamline your operations and hopefully increase profitability.

So where should you start when trying to keep good financial records for your business?

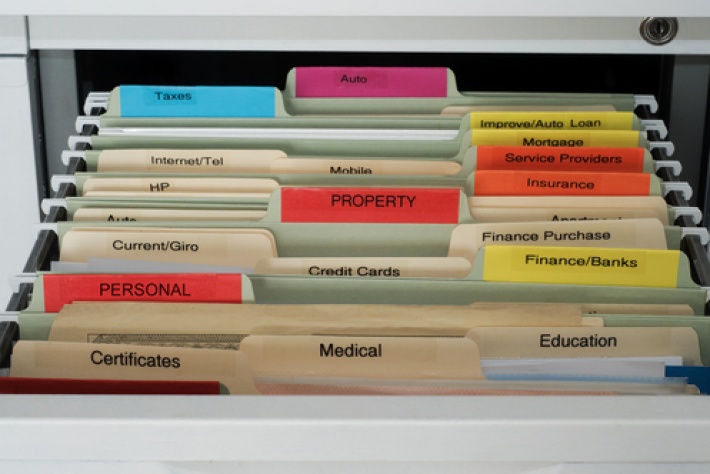

Get a system

This is the first and most important step to getting on top of your financial records. There are numerous systems that you can adopt; everything from keeping paper records, to using a simple spreadsheet or there also both desktop and cloud based accounting or bookkeeping systems and software packages that you can use. Exactly which would be right for you depends on your business. But once you have found the right one for you then it is important to stick to it.

Many people prefer cloud based systems as you don’t have to worry about losing your data and can access it easily – even from apps on your phone. Your accountant or bookkeeper can also access your record directly making things even easier all round.

Keep on top of your records

The best thing to do is to deal with your records as and when they happen, however we understand that this isn’t always immediately possible. However letting your records pile up means that you are more likely to overlook things or make mistakes. Therefore it is a good idea to set aside a regular portion of time to deal with your records, whether that be first thing in the morning, when you get home a night or once a week on a Saturday morning then do this and make sure that you stick to it.

Separate business and personal finances

Even if you do nothing else, it is paramount that you keep your business finances separate from your personal ones. It is a good idea to open a separate bank account purely for your business and use this for all of your business income, expenditure and expenses. This way it will be easier for you to keep track of your business records and won’t be at risk of getting things mixed up. It will also be much easier for HMRC to check your records if they ever decide to do so, and lower the likelihood of you being accused of tax avoidance.

Understand what you need to record

There can also be confusion about exactly what you need to record. In short the answer is everything. If you end up recording some information that you don’t end up needing then this is significantly preferable to having missing information when it comes to submitting your accounts or tax return.

The most important things that you need to ensure that you accurately record include:

- Receipts – You will need to prove every bit of expenditure that you make as part of your business, so ensure that you keep all receipts and sales invoices. Many companies prefer to keep these electronically, either by saving any digital copies or scanning and saving any paperwork that you receive as you go along.

- Invoices – Ideally you should have an invoice relating to all income that comes into your business. These should record the amount, date and what type of work it is referring to – and should be able to be reconciled with your bank statements.

- Bank statements – These should be reconciled at the end of each month (or whenever they are produced) and should tally up exactly with the receipts and invoices that you also have recorded.

- Depending on your business you may also need to keep records for things such as; payroll, cash books, vehicle use logs, travel logs, tax returns, stock takes and credit card statements. HMRC or your accountant can provide further advice about what records you need to keep if you are either self-employed or running a limited company.

Get professional help

If all of this seems utterly baffling to you, then it could well be worth investing in a professional accountant or bookkeeper. Although this may seem like an unnecessary expense there are actually a number of ways in which it could be a profitable move:

- Your time is likely to be more valuable to the company in simply running it or winning new work, than struggling through your accounts.

- Professional accountants and tax advisors may be able to structure your accounts and expenses in a way which you would not know about and could actually save you more money that if you did your accounts yourself.

- Avoid penalties – by putting your accounts in the hands of a professional, you can trust that they will keep you completely compliant.

- Remember that their fees are deductible as a business expense.

However the problem can be that some business owners may find it difficult knowing where to find a trustworthy and reliable accountant to take the stress out of their accounts for them. Handpicked Accountants is able to recommend a number of exceptional accountants in your area, each of whom have been thoroughly vetted so you know that you will be working with only the very best.

Contact Handpicked Accountants today and take advantage of our free personalised accountant matching service, ensuring that your business’ financial records will be kept in great order.